Specialists in financial crime +

data & analytics

Our domain expertise

Anti-Money Laundering

Financial institutions continue to be exploited by criminals to launder the proceeds of their illicit activities. Whilst some of this activity has shifted to Payment Service Providers (PSPs) and crypto-exchanges, a significant proportion of it continues to be laundered through Retail and Corporate banks. The controls used to mitigate financial crime continue to suffer from the same weaknesses, as the final notices from the UK's Financial Conduct Authority regularly highlight. They are simply not targeted enough to the risks they are intended to address.

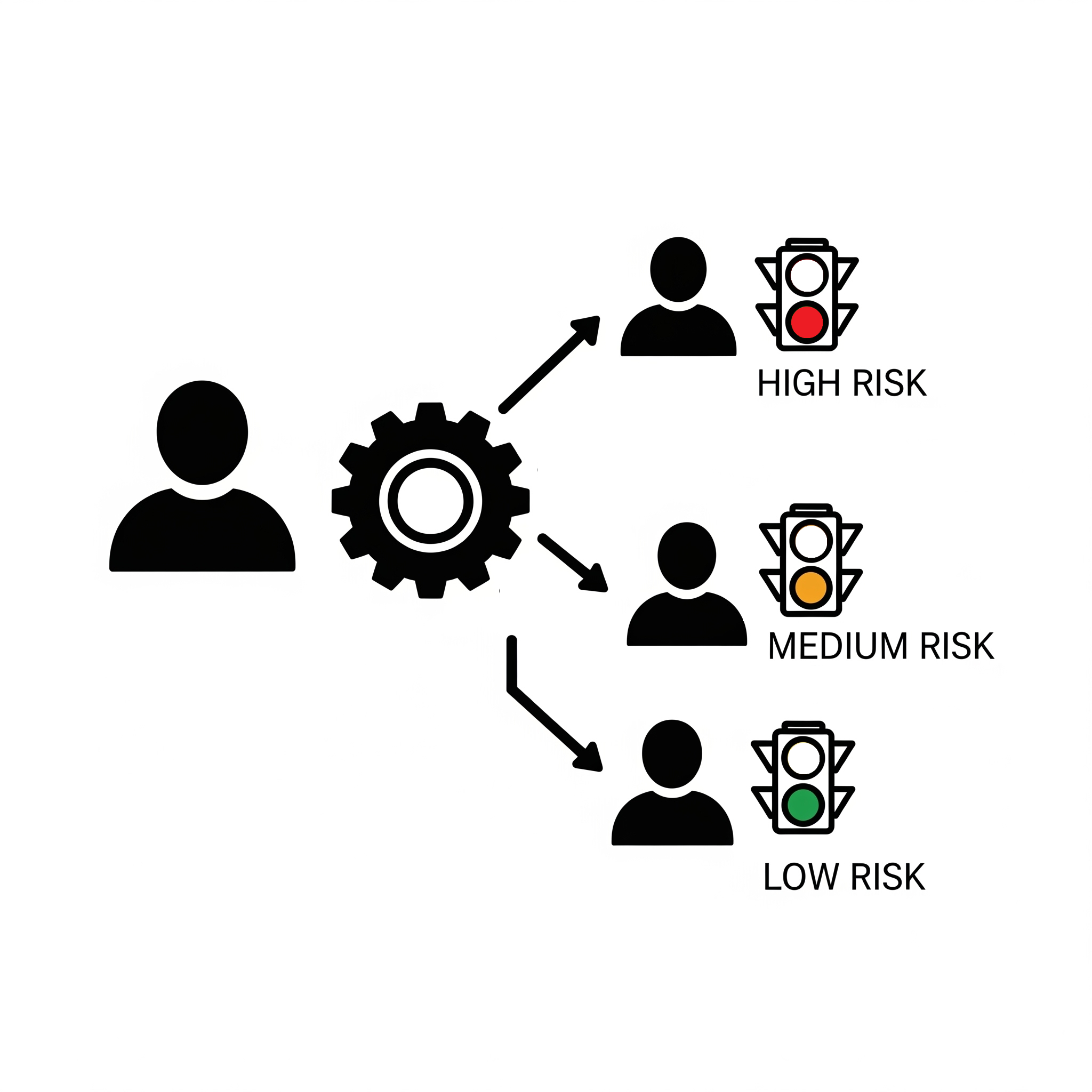

We help financial institutions to better understand the risks present in their organisation, evaluate the risks of their customers and more effectively identify suspicious behaviour.

Fraud

prevention

Whilst fraud continues to be a cost of doing business, and continuous optimisation of fraud prevention controls will always be required, the increased prevalence of scams has introduced new challenges. Regulators have demanded that financial institutions do more to protect and support consumers and so fraud prevention functions, which traditionally have been more aligned with credit risk and collections, are now finding themselves coalescing with compliance.

We help our clients to continuously improve their fraud prevention controls to reduce fraud losses, streamline customer journeys and operations to incorporate fraud prevention by design, and to understand where synergies between fraud and broader financial crime compliance can be utilised to create a simplified yet comprehensive control framework.

Sanctions compliance

Sanctions regimes have become more complex over time in an attempt to increase impact on their intended targets, whilst reducing unintended consequences on the broader population. This has also brought greater complexity in sanctions compliance. For most financial institutions however, the required approach to sanctions compliance remains broadly the same. Sanctions risk must be evaluated through Customer Due Diligence, Name Screening and Transaction Screening. Crypto asset firms must now also take this much more seriously as a result of the Travel Rule.

We help our clients to understand how sanctions regimes apply to them and optimise the sanctions systems and processes in place to identify the risks where they exist, reduce false positives, and reduce operational cost.

Our services

Risk

AML and sanctions risk coverage assessments

Product risk assessments

Transaction monitoring typologies review

AML and sanctions penetration testing

Data & analytics

Customer segmentation

Rule tuning (above-the-line and below-the-line analysis)

Bespoke model development

Model management

Data engineering

Data analytics

Data visualisation

Technology

AML Transaction Monitoring

Payments Fraud

Name screening

Payment screening

Watch list optimisation

Customer risk assessment models

Customer Lifecycle Management (CLM)

Social network analytics

Operations

Process review and optimization

Investigator training

Investigator certification

Establishing and management of KPIs

Automation of investigation narratives

Our clients

Malverde have supported many clients to design, implement and optimise their TM systems. Through this experience we have developed the following checklist to support clients in reviewing the suitability of their system to manage their unique risks and avoid large inefficiencies and costs.